The proposals from the FCA to end ‘opaque’ pricing techniques, particularly in the home and motor insurance markets, have been described by the regulator’s own interim CEO as a “radical shake-up”.

While the main talking point is the proposed ban on price walking, the FCA is also consulting on product governance rules intended to deliver fair value to all insurance customers. This means that it also brings into the ban any add-ons and premium finance, which could have a profound impact on the income earned by insurance brokers.

Reading the following lines from the FCA’s consultation report, it appears that the regulator plans to make brokers justify any mark up in commission from what they wholesale from a premium finance house to the final interest charged to the customer.

“….. where the firm proposes premium finance with a higher annual percentage rate (APR) than would be available elsewhere (for example, directly from the insurer, or from another finance provider), based on the remuneration the firm will receive, this may conflict with the firm’s obligations including the customers’ best interests rule.”

One premium finance provider has described the proposal as “earth shattering” and as some brokers have built this credit selling tool into their business models, it could have a devastating impact on their long-term profitability as a business. According to Consumer Intelligence data, some brokers charge anywhere between 13% and 20% compared to direct insurers, which typically charge between 8% and 13%.

This proposed move by the FCA isn’t necessarily specifically targeting brokers – it’s more about preventing any insurance firm compensating for losses on changes in dual pricing by maximising revenue at the back end through the likes of premium finance charges. The regulator said, in its consultation report:

“We will look closely at firms increasing the cost of premium finance to offset changes to the cost of the insurance product.

“Where the customer faces higher costs for the insurance product as a result of paying on credit, for example, due to a higher premium compared to the cost if paying without credit, the additional cost may constitute a credit charge and, if so, the APR must reflect these costs.

“If it does not, firms may be in breach of the Consumer Credit Act 1974 and the associated regulations.”

Now of course this is still a proposal and there could be modifications once the consultation is complete and the FCA has more data. However, any reduction in the interest rates that brokers charge customers on premium finance could have serious repercussions. So how can they make up this potential shortfall in their finances?

I think the key is not to focus on the premium finance aspect itself, rather on getting pricing strategies and levels right from the offset – and the key to making accurate decisions about risk and pricing is to be able to get a true picture of the customer.

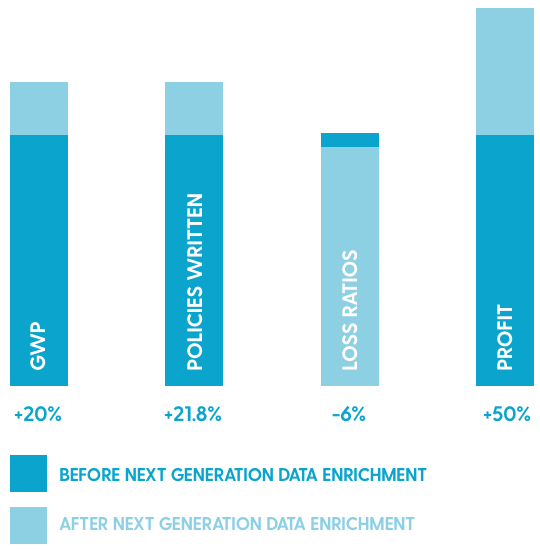

The best decisions are always based on the intelligent use of accurate and – most importantly – up-to-date consumer data. This requires accessing multiple industry and third party data points and combining those into a single customer view in addition to using new data sources such as open banking data which provide a clear view of shift’s in a customer’s lifestyle, spending patterns and financial status, and delivers a clear view of the risk they pose alongside their likely lifetime value.

This intelligence led approach enables brokers to offer each customer a premium that allows the business to make an appropriate margin, and reduce any dependency on inflating the interest rate on the premium finance to bolster the profit.

Given the FCA’s laser-like focus on delivering fair value to all customers, having a tight and well thought through data enrichment strategy can help ensure that brokers can demonstrate to the regulator that they understand their customers and are setting appropriate premiums that flex in line with the individual behaviour of each customer. Who could take exception to that?