When it comes to building artificial intelligence into risk evaluation and decision-making, I like to think of its role as that of a co-driver in a rally car.

The co-driver’s job is to navigate – reading off a set of pace notes to tell the driver what’s ahead, where to turn, the severity of a corner, what obstacles to look out for and the like. These notes are made during a first drive of the course, when the driver reads the turns and other info to the co-driver who makes notes based on an agreed system. This is repeated on a second drive, when the co-driver can fix anything wrongfully marked in the first drive.

It’s these notes that allow the driver to continue at full speed without hesitating in order to get the best possible time. Poor information or miscommunication can lead to a poor result – or worse!

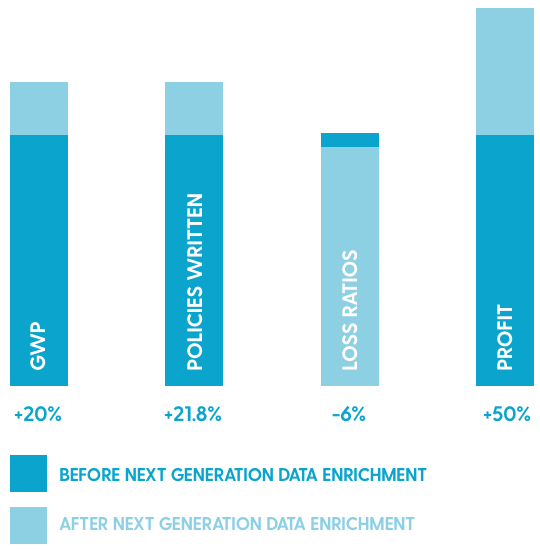

The point I’m trying to make is that any insurance provider deploying AI to aid their decision making whether that be in pricing strategies, fraud detection or claims settlement must be able to rely on the quality of the intelligence input and the AI’s ability to continually learn and adjust to a new course.

The notion that AI is foolproof has long been proven to be false. If the AI is fed poor information, it will deliver poor intelligence and the danger to the insurance provider is that they will draw wrong conclusions or make inaccurate predictions, resulting in nefarious outcomes.

I think that our vehicle valuation model demonstrates what best practice looks like.

- We source over 20 million data points from the whole market tapping into 100,000 global classified and trade sources every 24 hours to build a unique view of a vehicle.

- Data is then normalised and subject to scrutiny against a range of hygiene routines to provide a consistent view of the metal.

- Our data science team use machine learning techniques to model and derive value, offering a real-time market view at an actual VRM level

- We carry data on every single vehicle on the road and our values are tailored to the unique history of every vehicle. Our comprehensive all-market view is not skewed by a limited share of the market or a trade-based bias.

This insight, sourced from the whole marketplace built using industry-leading data science techniques, enables motor insurance providers, and many others in the motor trade, to access a demonstrably accurate view of a vehicle’s value including options, at any point in time, to help write the right quote and settle claims fairly.

This is just one example of how we’re building AI-powered intelligence and analytics that our clients can trust to help inform their decisions to achieve the best possible outcomes.

If you’d like to hear more about Percayso’s data and intelligence or the use of machine learning and advanced analytics then please get in touch at ‘hello@percayso.com’