KEY TAKEAWAYS:

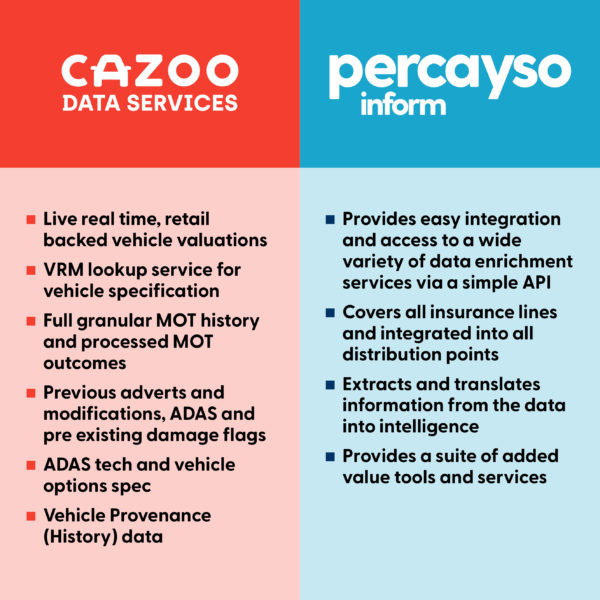

- Introducing Percayso Vehicle Intelligence (formally Cazana) following acquisition of Cazoo Data Services.

- The vehicle intelligence platform translates multiple, complex data sources into unrivalled insight at every stage of the insurance life cycle.

- Industry will benefit from being able to write better business that is based on real time, data driven intelligent insight.

In this blog, we take a deeper dive into the detail of Percayso’s vehicle intelligence platform.

Write better business

Having the right data to make decisions is imperative for success in the motor insurance market, but with multiple, siloed internal and external data sources, it has become a complex and resource heavy task. Percayso’s Vehicle Intelligence aggregates real-time data from many sources, accessible with a simple API, providing comprehensive vehicle data and intelligence ranging from vehicle valuations and specifications, provenance data, MOT history, specifications and vehicle modifications.

This enables insurance providers to price better, reduce fraud and make quick and informed decisions.

“The benefits of integrating the insight from Cazana into our platform are exponential. By combining that data and processing it in meaningful ways, you can derive additional benefits, for example: output, metrics, pricing, algorithms, fraud detection, quotes and manipulation flags, to enable you to write better business.” – Kieran Fisher at Percayso

This real-time intelligence delivers an unrivalled uplift for insurers and brokers, creating a powerful competitive advantage.

“Using Percayso Vehicle Intelligence (formally Cazana) gives us confidence that we are offering fair and accurate values to our customers, and we use the information within Companion to demonstrate that in the case of any disputes. We like that they are a digital-driven company and the valuations are constantly updated. The information available is very detailed, going as far as producing examples of vehicles which have recently been sold in the open market.” – Ian Brown at esure

Real-time data

This translation of mass-market data into real-time intelligence means users are able to go out and look at how the market and that individual vehicle is performing that day. Millions and millions of different data points provide live information ranging from what the market’s doing and how that particular vehicle’s performing against the retail market. That gives us a spectrum of vehicles that are directly comparable to be able to run that valuation proposition.

“After initial valuation, our platform allows users to go one step further and look at the specifics for that car. This provides intelligence on the vehicle’s history, and a timeline on everything that’s ever happened to that particular vehicle throughout its life cycle, such as previous MOT results on failures, dates, mileage, and ownership. It also provides financial information such as outstanding finance or PNC, if that car has been advertised previously detailing past advert specifications, descriptions, mileage and price, plus details from the manufacturers regarding vehicle specifications and technology.” – Kieran Fisher at Percayso.

The user instantly has a complete picture of everything that happens to that vehicle throughout its lifecycle. As a result, insurance providers can take this and make informed actions towards pricing and valuation whilst minimising the threat of potential fraud.

“The pricing algorithms quickly interpret and extrapolate as much information as possible from those data fields, providing the best pricing metrics to detect fraud and ultimately write better business. For claims, we now have a SaaS product called Claims Companion to help users navigate through and understand the vehicle and its specification, history and condition by looking at several data points on their screen. It provides an understanding of a vehicle’s value against similar listings as well as a detailed history timeline and is used by the governing body of insurance disputes as their preferred guide to be able to settle any disputes.” – Kieran Fisher at Percayso

Businesses are able to intuitively build, adapt and optimise their own data enrichment rating and intelligence strategies, and take control of their strategies and deployment by enabling rules and models into their environments via a SaaS and/or an API model. This is critical for both underwriting, where teams need that data via API very quickly, requiring information to be processed at speed and delivered in a standardised format, and claims.

“At the time, we were using at least three different sites and suppliers for the data we needed; however, after swapping to Percayso Vehicle Intelligence (formally Cazana) we got all that data in one place at the click of a button. Resulting in less research work to be done by our team, helping us to increase our overall productivity.” – Andy Lee at Incident Management Solutions (IMS)

A new era of vehicle intelligence

Traditional vehicle data tends to be inaccurate, expensive and outdated, leaving the industry in dire need of something new. Percayso provides the tools, intelligent data and information to change this at every stage of the insurance life cycle and provide the insight needed to write accurate insurance quotes and settle claims seamlessly.

“Now that Cazana is in-house, Percayso has a lot more control over the processing of that data and can continue to develop and push that data and unlock more potential. We’ve really become the kind of go-to one stop shop for enrichment, whether that be vehicle intelligence, product intelligence or multi-bureau data. We can build customer trust and spot fraud quicker – a compelling new approach and package.” – Kieran Fisher at Percayso

Real-time data allows all parties to work with the highest levels of accuracy and ensures that any potential risk can be identified, and accurate quotes can be priced and generated competitively. Underwriting, pricing and claims teams can all use the same service in ways tailored to their needs, ensuring they are cohesive yet consistent and transparent across the board. Third parties, the financial ombudsman, credit hire companies, all able to use the same data. But that also goes further than that. It takes vehicle intelligence and data enrichment and utilises it to provide the industry standard.

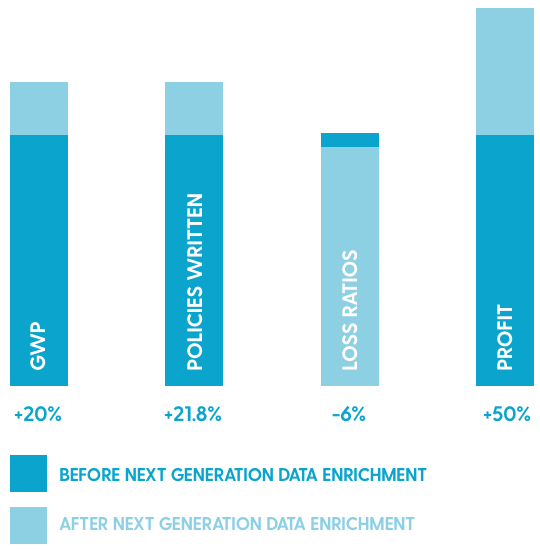

By providing next generation insurance insight and tools, Percayso can deliver unrivalled uplift for both insurers and brokers, creating a decisive competitive advantage.

“As a business, we have great customer retention which means we have to offer the best customer service and use the best systems – and that’s why we use Percayso.”. – Alex Beckingham-Baird at NFU Mutual

It’s clear that every provider in the insurance ecosystem will continue to need to make constant intelligent decisions at every stage of the insurance life cycle if they are to remain competitive. Complimented by the Cazana, Percayso’s solutions is set to deliver exactly that.

To learn more about Percayso’s Vehicle Intelligence, speak to our team today.